Cheer up!

The federal income tax system really does soak the rich. In 1997, as pundit Tony Snow recently observed, the top 1 percent of earners paid 27 percent of income taxes; the top 10 percent paid 63 percent; the top 20 percent paid 77 percent; and the top 50 percent paid about 95.7 percent. That means the bottom half pays very little income tax (although those taxpayers do pay Social Security taxes, a regressive tax that is only paid on the first $68,400 earned).

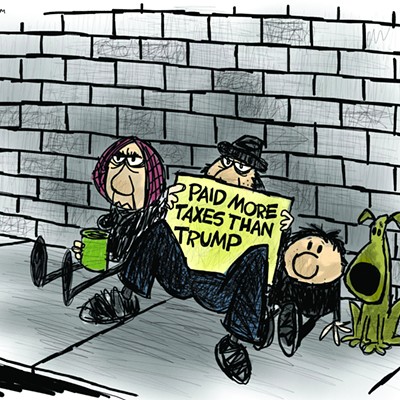

Given the tendency of congressmen to serve their contributors, many of us naturally assume the wealthiest Americans use loopholes to escape their tax burden -- but there's no getting around the fact that they do pay the most in taxes.

"They perhaps don't pay at the nominal rate, but the data is indisputable," says Michael Ettinger of Citizens for Tax Justice, a Washington, D.C., watchdog outfit that advocates relief for middle- and low-income taxpayers. "They pay a lot more in income taxes than they do in other taxes."

It's a similar situation in Arizona, although the state income tax isn't nearly as progressive as the federal tax. According to figures from the Joint Legislative Budget Committee, in 1997 the top 1.4 percent of filers (those with more than $200,000 in federal adjusted gross income) paid 17.3 percent of all state income taxes; the top 5.7 percent (income of more than $100,000) paid 31.2 percent of all state income taxes; and the top 11.2 percent (income of more than $75,000) paid 42.7 percent.

None of which means there isn't plenty of waste, fraud and abuse in government, both national and local. (More on that later.) Nor does it mean that the current tax system is so perfect it couldn't benefit from reform. It just means that, despite popular perception, wealthy Americans do shoulder much of the federal income-tax burden -- and to a lesser extent, the state income-tax burden.

Now, if you happen to be in the top 1 percent of incomes, you probably don't find much of the above to be happy news. But there's probably not much reason for you to be glum either, because the last decade has likely been very, very good for you; in 1997, after taxes, the top 1 percent had an average $515,600 left to play with, according to the Center on Budget and Policy Priorities, another D.C.-based non-profit dedicated to advocating for low-income families. In a report released last year, the organization reported an ever-growing gap between rich and poor, to the point where the top-earning 2.7 million Americans -- that cream of the crop in the top 1 percent of income -- have as many after-tax dollars as the bottom 100 million.

Bottom line: If you're earning that much, you can probably afford to shell out a little more than the Average Joe. Besides, Congress continues to create more and more of those blessed loopholes, even as many elected officials are complaining the tax code is too complex and needs to be scrapped altogether.

The ultimate result of most of these schemes to replace the much-despised Infernal Revenue Service -- with simplified flat taxes or a national sales tax -- will mean lower taxes for the wealthiest Americans, who likely don't need a break. And if we're going to make up the difference, that means a tax hike for the rest of us, who probably can't afford it.

TAKE, FOR EXAMPLE, the Taxpayer Protection Alliance, which is currently collecting the 152,643 signatures they'll need by July 6 to put the Taxpayer Protection Act of 2000 on the ballot in November. The initiative would phase out the state income tax over four years. To replace the revenue generated by income taxes, lawmakers would have to get public approval at the ballot box for any new tax.

Lori Klein, executive director for the Arizona Taxpayer Alliance, says the group has collected more than 100,000 signatures. She reports the group has raised about $150,000 and is paying petition gatherers $2 per signature.

The Arizona Taxpayer Alliance is chaired by Dick Mahoney, a Democrat who served as Arizona secretary of state from 1990 to 1994, when he stepped down to make an unsuccessful bid for the U.S. Senate. (Mahoney was unavailable for comment, Klein said, because he was building orphanages in Latin America.) Other notable supporters include Arizona Congressman Matt Salmon, former Arizona attorney general Grant Woods, and Dr. Jeffrey Singer, a Phoenix physician who has also been active in the state's medical marijuana initiative battles.

Although Klein argues that wealthy taxpayers escape paying taxes through loopholes, she concedes that the numbers show that most income-tax revenue comes from the highest brackets. "The wealthy in this country don't have problems with the income tax, but the little small guys often take a big hit," says Klein, who describes "little, small guys" as "small entrepreneurs making between $100,000 to $1 million a year" -- which accounted for approximately 5.6 percent of the filers in Arizona in 1997.

Singer argues that cuts in the income tax over the last decade have resulted in a corresponding rise in job creation, and that states without income taxes have attracted many high-tech jobs. So eliminating our state income tax would give everybody more money to spend, lure New Economy corporations to Arizona and spur a massive economic boom. "Eliminating the Arizona personal and corporate income taxes is the most effective and efficient social welfare program our state can ever put into place," Singer says.

Elizabeth Hudgins, a staffer with the Children's Action Alliance, has a different spin. "As I understand the initiative, it eliminates half of our state budget and makes it incredibly difficult to replace," Hudgins says. "It gets rid of our most progressive tax feature, which is the income tax, and if it is replaced with anything, it's going to have to be something more regressive, so eliminating half the state budget without a good way to replace it isn't the best possible thing you can do for Arizona."

Hudgins points to a recent study by the Center on Budget and Policy Priorities, which reported that Arizona's income tax was among the best in the nation for low-income families, who can earn up to $23,600 before they owe any income tax.

She also notes that a Joint Legislative Budget Committee reported that a typical household that earns $35,000 paid about $515 (or 15 percent of its annual state tax bill) in income tax, while shelling out about $1,440 in sales taxes (or 42 percent of the annual bite). The JLBC estimated that households with annual income of less than $500,000 -- that's about 99.7 percent of the state's population -- paid more in sales taxes than in income taxes.

"It's not as if the money goes into some black hole," Hudgins says. "It builds roads and schools and libraries and provides services for abused children and a whole host of things that people value from those dollars."

Ettinger, of Citizens for Tax Justice, predicts the effect of eliminating the state income tax would be to increase taxes on the average Arizonan. "It would shift the relative tax burden off higher-income people and onto lower-income people, because relatively speaking, the state would be getting more money from sales taxes and other consumption taxes, and property taxes, and less from progressive income taxes. If you don't replace the revenue, then the middle- and low-income people wouldn't see their taxes go up, but they'd see government services decline to a much greater degree than their taxes would go down, because so much of the tax benefit would go to the wealthy."

Marshall Vest, the UA economics professor who frequently serves as the voice of conventional wisdom in these sorts of policy matters, notes that flushing the income tax will place the entire burden of financing government on the sales tax, give or take the occasional fee. "That would be a very, very different tax system than what we're used to," Vest says. "If we were to eliminate the state income tax, it would mean one of two things: Either you'd have to raise the sales tax, which now is 5 percent, and it would probably have to go to 9 or 10 cents on the dollar; or you would have to shrink government by a third, or about 40 percent. The question is: if you're going to do that, what is it you're going to eliminate?"

That's a question advocates of the Taxpayer Protection Act don't tackle. Although the group's Web page notes that "there certainly must be one or two areas where savings can be realized," potential trims are not forthcoming. The Web page sidesteps the issue of replacing the revenue stream with this dodge: "The important thing to remember is the Taxpayer Protection Act only deals with the WAY in which revenues are collected -- not the way in which they are next distributed or allocated. To link the two issues is to mix apples with oranges."

"It's comparing apples to apples," Ettinger argues. "You're losing this revenue and you have to make it up somehow. It's unclear to me how voters are supposed to make an intelligent decision on the consequences of eliminating the income tax if they don't know (a) if it's going to be replaced and (b) if it is replaced, how it's going to be replaced."

Singer argues that it might not have to be replaced at all. He projects that at the current rate of growth, the Arizona economy will reach a point by the year 2006 where sales taxes alone bring in as much money as sales and income taxes do today. Thus, the income tax could be trimmed significantly each year, as long as the state budget remained frozen at $6.5 billion a year for the next seven years. Given that the state budget has grown from just under $4 billion seven years ago to roughly $6 billion this year -- an increase of 50 percent -- it seems unlikely, with a steadily growing population demanding more services, that a seven-year budget freeze is politically viable.

In his best-case scenario, Singer suggests the elimination of both personal and corporate income taxes would result in an economic boom that will trigger a rapid rise in sales-tax revenue.

Vest is "more than a little skeptical" of that claim. "It just doesn't work that way...That's the supply-side argument. Not too many people understand what the supply-side argument is all about. What they're contending there is that the economy would grow so much that the revenues would more than replace the amount of revenues lost through the elimination of the income tax. That means the economy would almost have to double in order to do that."

That's unlikely enough, but if it were to happen, it would raise another question, says Vest: "If the economy does double, doesn't the demand for public services go up? And how do you pay for that? If you have twice the number of businesses and twice the people, doesn't welfare double, the cost of educating children double, right on down the line?"

Singer admits that things might be tough for seven or eight years with his plan, but says government needs to tighten its belt, although he's vague when it comes details. He doesn't see any area of government that needs any more money -- not even Arizona's chronically underfunded education system, which is potentially facing a billion-dollar bill just to build new schools and bring old classrooms up to a reasonable standard.

Klein is more generous -- she says she supports Gov. Jane Dee Hull's recent proposal to ask voters to approve a .6 percent sales-tax increase, because that's a tax increase that has to pass at the ballot box.

Analyses by Citizens for Tax Justice show that states without income taxes tend to collect a greater share of taxes from lower- and middle-income taxpayers than states with income taxes. Ettinger has no doubt that "if you replaced (the income tax) dollar-for-dollar with consumption taxes, including a sales tax, you would end up with a system where middle- and low-income people pay more and upper-income people pay less. Low-income people have to spend all their money to survive, basically. Middle-income people, to have a decent lifestyle, spend most of their money. Wealthy people spend a relatively small percentage of their money, so by definition a tax that taxes what people spend is going to hit middle- to low-income people much harder than wealthy people."

Increasing the sales tax could have another detrimental effect on the business community: since there's no sales tax on Internet commerce, a steeper sales tax -- particularly in the 10 percent range -- would increase the incentive to shop online, which further hurts local business owners. Not only would the brick-and-mortars lose sales and see their profit margin shrink, but the tax burden would further shift onto taxpayers who don't shop online.

FOR THE TAXPAYER Protection Alliance, the elimination of the state income tax is just the first step in the elimination of the federal income tax. As the Web site proclaims: "We can start the second American revolution right here in Arizona!" Singer points out that no other state has ever voted to dismantle an income tax. If Arizona were to do so, he reasons, other states would soon follow suit, and the federal government would soon be forced to follow suit and shut down the IRS.

While they shy away from backing any specific federal tax-reform plan, Singer and Klein both have kind words for the proposed "FairTax," which was scheduled for a hearing this week in Washington, D.C.

The FairTax is the brainchild of Houston multi-millionaire construction magnate Leo Linbeck Jr., and a few of his close associates, who as of 1998 had contributed the lion's share of the $15 million the group raised to fund economic studies at prestigious universities, a large-scale polling project and an advertising blitz.

The FairTax would replace the income tax, corporate taxes, estate taxes and Social Security payments with a national sales tax of 30 percent. To address the regressive nature of such a tax, every American would also get rebate checks from the government each month to cover the cost of the tax on necessities like groceries and housing.

Fair Tax supporters don't actually say their proposal would require a 30-percent tax, however. They call it a 23-percent "tax-inclusive" rate. In other words, they've arrived at their 23 percent number by figuring that $30 is 23 percent of $130 -- the $100 price tag on an item, plus the 30 percent tax -- "which isn't the way anyone thinks about a sales tax," says Ettinger. (See "Tax Cheats, Tucson Weekly, December 10, 1998).

The tax-inclusive rate seems to confuse even the FairTax's supporters. Singer and Klein, for example, were convinced that under the proposal, the tax would be $23 on a $100 purchase. Klein's misunderstanding is particularly surprising, given that she was working with the Arizona chapter of the FairTax's organization.

After Klein was faxed information about the math trick, she told The Weekly, "That was the first I had ever heard anything like that and I need to investigate that further before I even want to comment on that." Asked her opinion of a 30-percent national sales tax, she said, "I personally think it's way too high...But then again, if they're going to truly rebate everybody up to subsistence or poverty level, then I think it is worth it."

Ettinger says the group's numbers are flawed beyond the funny percentages. "A third of their revenue comes from taxing government, as if taxing government purchases raises any money," Ettinger says. "Yeah, on paper you could say we're going to raise a ton of money by taxing government, but everything the government buys now costs 30 percent more. So you have to raise taxes more if you're going to do that. If this worked, we could just leave us people out of it and just have government continually taxing itself to pay for everything. It's ridiculous. If you take that out, you're up to about a 40- to 42-percent rate."

And that's before you figure in state and local sales taxes, which could drive the rate higher than 50 percent.

Supporters of the FairTax say the increase in prices wouldn't necessarily be that high, because eliminating corporate taxes would allow businesses to drop the price on goods.

But even so, a sales tax nearing 50 percent will create a huge incentive to evade the tax by shopping across the border, at off-shore Internet shops or at second-hand shops.

"Look, when you start getting up around a 50 percent sales-tax rate, the efforts people will make to evade it would be incredible," Ettinger says. "And it wouldn't be that hard. To evade the income tax takes some pretty fancy footwork and collusion among the (political) parties. Evading the sales tax would be much easier. All of a sudden I think Nogales would have a lot of shopping malls. I don't think Tucson would have many left."

AS MENTIONED ABOVE, there's no question that government at every level squanders several tax dollars. Just last week, Citizens Against Government Waste released its annual Congressional Pig Book Summary, exposing pork-barrel spending in Washington. Thomas A. Schatz, president of the group, charged that Congress broke all previous records for pork with a staggering $17.7 billion in worthless spending. (For details, check out the group's website at www.cagw.org).

The income-tax system, particularly at the federal level, would benefit from reform as well. For example, Congress could trim some of the loopholes that allow wealthy taxpayers to escape paying some of their taxes. Congress did just that in 1986, but persistent lobbying has allowed many of the barnacles to grow back. Ettinger estimates, for example, that last year's bill increasing the minimum wage by a dollar had $11 of tax relief for wealthy Americans for every buck in increased wages for the lowest-paid workers. "It was a joke to call it a minimum wage bill," says Ettinger.

Ask Marshall Vest what the best overall tax policy is, and he doesn't equivocate. "Absolutely the best policy is to keep a broad tax base and keep rates low. If you keep rates low, you don't mess up the decision-making of economic agents. And that's what you want. You don't want behavior to change because taxes are so high that people spend a lot of time and effort to avoid the tax. If you keep the rates low and the gain small for engaging in those sorts of activities, then you won't affect economic activity.

"That's the best designed system and it's been in the textboks for years and years and years. In the last decade or two that teaching has fallen by the wayside," Vest adds. "People have either not learned that or they've forgotten it."

VALUE JUDGMENTS

THE INCOME TAX may not be the only tax Arizona voters have a chance to monkey with this November. There's a slim chance they'll also see a property-tax proposition on their ballots.

Earlier this week, state lawmakers killed a proposal to place a referendum on the ballot which would freeze property values for seniors ages 65 and older who meet certain income criteria. Supporters vowed to resurrect the issue in the closing days on the session.

A more radical version of the plan, which would freeze all residential and business property values and force voters to approve increases in property tax rates, was killed by lawmakers earlier this year. The legislation was proposed by District 9 Rep. Bill McGibbon, who represents eastern Tucson, Green Valley and Sierra Vista; and Rep. Jerry Overton, who represents Litchfield Park near Phoenix.

McGibbon, who's seeking to move from the House to the Senate in November, didn't return a phone call for comment on his proposal. Overton, a Republican from Litchfield Park, says he hopes their plan can reach the ballot via an initiative effort.

"Bill and I both happen to believe that people who own property, both businesses and homeowners, are being taxed without their consent," says Overton. "It keeps going up every year and it's not right."

Pima County Assessor Rick Lyons, who is charged with overseeing the fair valuation of property at market rates, says the proposal would be a disaster.

"The fundamental public policy problem with this kind of an approach is it dwells on the concept of value and the manipulation of levels of value in order to deal with tax relief," Lyons says. "That is a fundamental myth and an illusion. It is a very common myth that manipulating values can provide tax relief, but I have to assume that people who are in a public policy position know better than to do that. If there is a sincere desire to provide tax relief to a certain group of taxpayers, the last thing you do is look to the valuation system, because the valuation system merely distributes liability from property to property. It does not determine the total liability against the total tax base."

As Lyons explains it, the notion behind fairly distributing property taxes depends on accurate valuation of the property. When the assessor has accurately set the value of the tax base, then the tax rates set by the Board of Supervisors, school boards and other taxing jurisdictions should be evenly distributed based on the value of each property. In a perfect world, as property values climb, property tax rates can be lowered to compensate for the rising values.

Unfortunately, in Pima County and elsewhere in the state, the Board of Supervisors and other taxing jurisdictions haven't done a very good job of reducing the tax rate to compensate for the ongoing boom in the real-estate market, so property taxes have been climbing for the last few years.

To counter that increase, Overton and McGibbon propose to freeze property values. But Lyons says that strategy would be disastrous, because if property values were frozen until homes are sold or substantially improved, then the value of equivalent properties would fluctuate wildly. That makes it impossible for property taxes to be fairly distributed.

Overton is unconcerned about equitable distribution of the property tax burden. "Nothing is equitable about it now," he complains. "My valuation of my home has gone up three times in the last three years. The guy next door, who has an almost identical home, hasn't gone up at all. Of course, they always say you can go to court and fight it, but why should I have to? That's not right."

Under Overton's plan, however, homeowners wouldn't even have the option of going to court -- or more accurately, through a property value appeals process -- to tweak their property values. Instead, the value would be locked in at the sale price. While it would be a good deal for longtime homeowners, it would leave a much higher tax burden on anyone who buys a new home.

UA economics professor Marshall Vest says California voters passed a similar law, Prop 13, about two decades ago. "In the process, they wound up throwing their government into a crisis and almost ruining their public education system," says Vest. "You have tremendous inequity in that system. It's a terrible system. We should have learned from California and that debacle from two decades ago, but we're still talking about it."

Overton says Vest is just plain wrong. "Proponents will say just the opposite -- there was a little bit of, I guess, confusion or whatever it happens to be, the first few years, but if you look at California now, they are in excellent shape, I think maybe because of that."

It seems unlikely that voters will have to make a decision on the proposal in November. Overton says he has no idea how many signatures have been collected, but it's nowhere near the 152,643 needed to put the proposal on the ballot.

"We have been kinda holding off until we make sure this bill doesn't get out of the Senate," he says. "If it were to get out of the Senate, we wouldn't need the signatures."

But Overton was skeptical last week that lawmakers would agree to place the issue on the November ballot. "Probably next week we'll crank it up," he says. "If we fail, we can try again next year."

While rising property taxes get his goat, Overton says he's reasonably happy with the current system of supporting state government through income taxes and sales taxes.

"I don't have a real problem with our system the way it is now," says Overton. "There are a lot of tweaks that could be done. What I have a problem with is in my opinion the unnecessary increase in taxes that government wants. Government wants more money for more programs to do this or that."

So how would he vote on eliminating the state income tax?

"Well, I think it will become a problem, because I think that people demand services and demand a level of services," Overton says. "I probably would vote for it, because it will drive us legislators back in to, you know, have to bring some money somewhere else, make us look at our priorities a little better."

And if the proposition to eliminate the state income tax passes, what would he do to replace the revenue or cut spending?

"That's another subject I'll just not even comment on," Overton says. "I'll just wait until next year." -- By Jim Nintzel