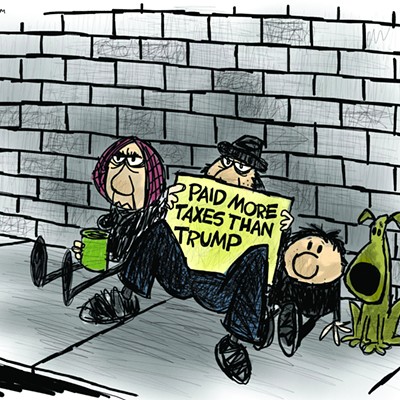

And the increase that City Manager James Keene seeks is huge: 73 percent. But Keene won't pay any of that increase on the Sam Hughes home he and his wife bought for $430,000 some 2 1/2 years ago.

Keene and his City Council supporters are banking on a tax paradox to push through a property tax that will nearly double the city's clearly low property tax revenues. Nearly 80 percent of Tucson homeowners will be exempt, like Keene, from the tax increase, because they are within the high-tax Tucson Unified School District.

The taxes homeowners pay for daily operations of TUSD, Pima County, the city, and Pima Community College already eclipse the limit set by the state. In broad terms, the owner of a $100,000 home can pay no more than $1,000 a year in total property taxes for those governments' daily operations. Keene's proposed tax increase will do nothing to increase the property tax bill for the James and Iris Keene home. Taxes that the Keenes pay for government operations will remain at $2,780.

That benefit will not extend to homeowners in the four other metropolitan school districts that overlap the city. They'll pay the full price. The $15 extra for the year--the increase for a $100,000 home--may seem small, just as the $36 bill for City Hall's daily bills.

But many of the owners of the 7,900 homes in the Sunnyside Unified School District are on fixed incomes, said Councilman Steve Leal, the Democrat who has represented southside Ward 5 since 1989.

Even in homes half that value, and with half the tax bill, the increase becomes too much, Leal said, because of the other increases in city fees, from the $2 a month charge for brush and bulky debris removal to stiff increases in parks and recreation charges.

Including the city property tax used to repay voter-approved debt, the owner of $100,000 home will pay $131 in city property taxes under Keene's scheme.

Owners of business property will get hit full force. Despite some reductions in recent years for business taxes, including exemptions on business equipment for most mom-and-pop operations, business property pays at a ratio that is 2.5 times higher than that for residential property.

Keene's increase of primary property taxes--for daily operations--will boost that portion of tax revenues from $4.6 million to $8.4 million. That will help soften the blow of a projected $6 million drop, to $168 million, in revenues from the city's two-cents-per-dollar sales tax.

Keene traveled to Austin, Texas, last weekend and was not available for comment for this story. He is closely aligned with Mayor Bob Walkup, the Republican seeking a second term in the face of a challenge from former Mayor Tom Volgy, a Democrat.

Two of Walkup's biggest backers, restaurant magnate Bob McMahon and car dealer Jim Click, will get smacked if Keene gets his way.

The centerpiece of McMahon's Metro Restaurants chain--McMahon's Prime Steak House at North Swan and East Fort Lowell roads--and the adjoining office and retail property are valued for tax purposes at $2.05 million. Under Keene's plan, McMahon will pay $1,468 in city primary taxes, up from $894 on the steak house and commercial center. That remains a small portion compared with the $77,350 in total property taxes generated by the properties.

Click's Ford dealership at 6420 E. 22nd St. is the cornerstone of his Tucson auto empire. On the tax rolls for $4.3 million, the property will generate $3,714 in city primary property taxes, up from $2,149. Total property taxes on the parcel this year are $172,720.

Neither McMahon nor Click raise much of a fuss about local property taxes. They have been essentially mute on Pima County, which has the highest property tax of any Arizona county.

Keene, critics say, is toying with a property tax cap meant to protect homeowners. Because the balance--any amount over the homeowner's limit--comes out of the state general fund, the manipulation will backfire when a Maricopa County-dominated Legislature exacts some retribution.

"This little game you're playing with the state won't work," Leal says. "They're going to take it out somewhere else. Budgets are always a zero-sum game."

Keene did not discover the manipulation, although he may be the most brazen in seeking the advantage.

Longtime Pima County Supervisor Dan Eckstrom, a Democrat who is more skillful and less obvious, briefly proposed a plan in 1995 to shift some separate county taxes, including those for flood control, to the primary rate, thus forcing the state to pick up a greater portion of Pima County's bills.

TUSD Board President Joel Ireland belittled a big tax increase two years ago as "fantasy" because TUSD homeowners were already maxed out.

George Cunningham has seen the reaction as chief of staff for Gov. Rose Mofford, as a Democratic legislator and now as Gov. Janet Napolitano's chief budget adviser.

Though some taxpayers in Maricopa County are now within that high-tax cap, Maricopa legislators see the moves as a taunt, Cunningham said.

"It is sort of a festering sore that arises when inflammatory statements are made by local officials that, 'Oh well, the state will pay for this,'" Cunningham said.

"It is inflammatory because it doesn't take into account business and non-residential property. The money comes from the state general fund, into which we all pay income and sales taxes, and it raises the ugly face of regionalism (allowing Maricopa lawmakers to scoff that) it's being done by people who drink funny water down there south of the Gila River."